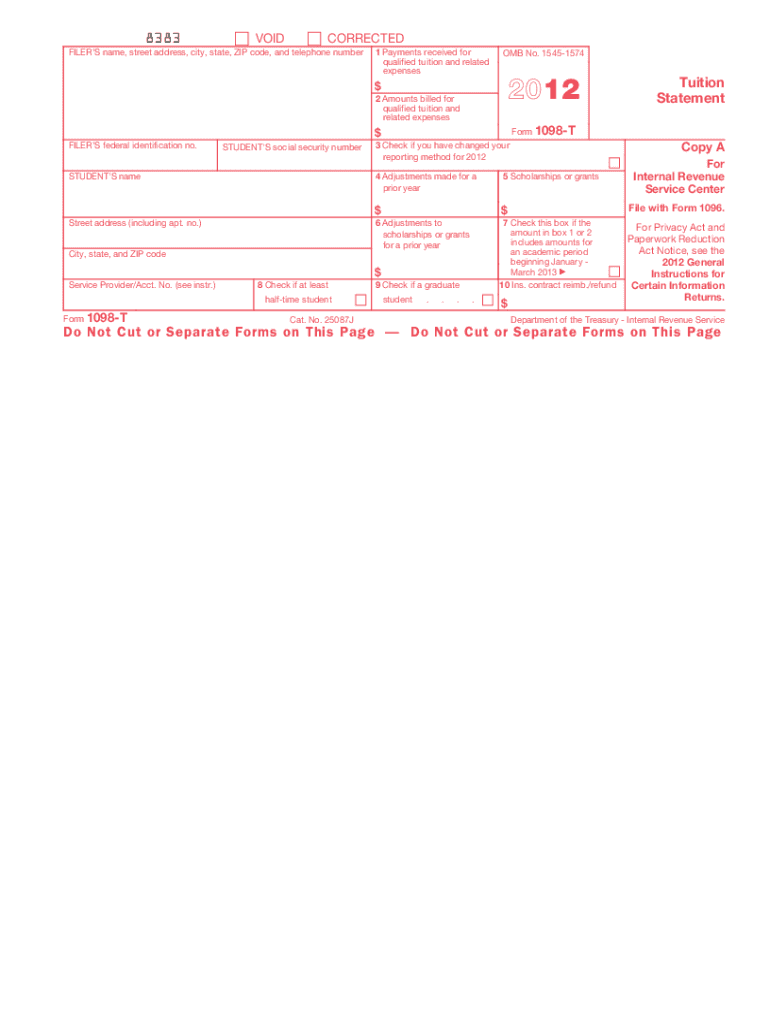

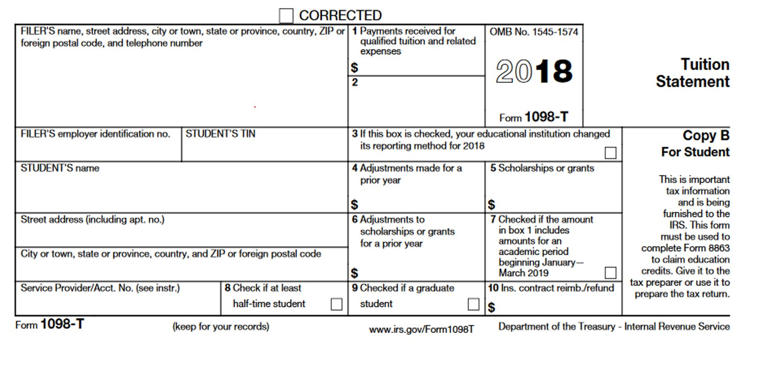

Schools use Box 1 of the form to report the payments received.

1098 T FORM HOW TO

If you have specific questions about how to report the 1098-T, please contact a tax specialist. Eligible post-secondary institutions must send Form 1098-T to tuition-paying students by January 31 and file a copy with the IRS by February 28. Please allow up to five business days for a response.īYU does not issue advice or counsel about how to file taxes. Your 1098-T will be mailed by January 31st and. Taxpayers should consult their tax advisor or IRS publications to determine eligibility. The issuance of this form does not imply eligibility to claim the tax credit. If you have questions about whether you are eligible for a 1098-T, please email or call 80 The form also provides financial information regarding qualified tuition and related expenses that HC has received on your behalf. The most common reasons for not being issued a 1098T include: If you do not choose electronic delivery, the 1098-T should be mailed to your permanent mailing address listed on MyBYU. When you navigate to this page, you will be asked if you would like to elect online delivery of the 1098T. You can access the information online through My Financial Center > Other > Tax Information > IRS Form 1098-T - Tuition Statement. All eligible educational institutions must file a Form 1098-T to report information to the Internal Revenue Service (IRS) for each qualifying student for. You, or the person who may claim you as a dependent, may be able to claim an education tax credit on IRS Form 1040 for the. The IRS Form 1098-T that you receive reports amounts paid for qualified tuition and related expenses, as well as other related information. These students are exempt because non-resident aliens are not eligible. The IRS Form 1098-T is an information form filed with the Internal Revenue Service. The information provided can be used to determine your eligibility for certain tax credits including the American Opportunity Credit and the Lifetime Learning Credit.īYU typically publishes the 1098-T forms at the end of January (January 31). Virginia Tech is not required by the IRS to file a Form 1098-T for non-resident aliens. It provides documentation for tuition and tuition-related expenses that are paid in a calendar year. A 1098-T form is an IRS tax form that BYU fills out and sends to the IRS for most students.

0 kommentar(er)

0 kommentar(er)